“And Mom, I’m bringing someone who might be helpful—a financial adviser Andrew and I have been working with, just to give you some perspective on your options.”

Options.

What she meant was their plan.

After we hung up, I immediately called Rachel, then Hayes.

“It’s happening,” I told them both. “They’re inviting me over with a financial adviser.”

“Perfect,” Hayes said. “Don’t sign anything. Don’t agree to anything. Just listen. Act uncertain—and if possible, record the conversation.”

“Washington is a one-party consent state,” he added. “You can legally record conversations you’re part of.”

Rachel came over Friday night to help me prepare. She brought a small digital voice recorder her grandson had given her.

“Put this in your purse,” she said, showing me how to press the button. “Eight hours of battery. Just turn it on before you go in.”

“I feel like a spy.”

“You’re not a spy,” Rachel said. “You’re a mother protecting herself from people who want to steal from you.”

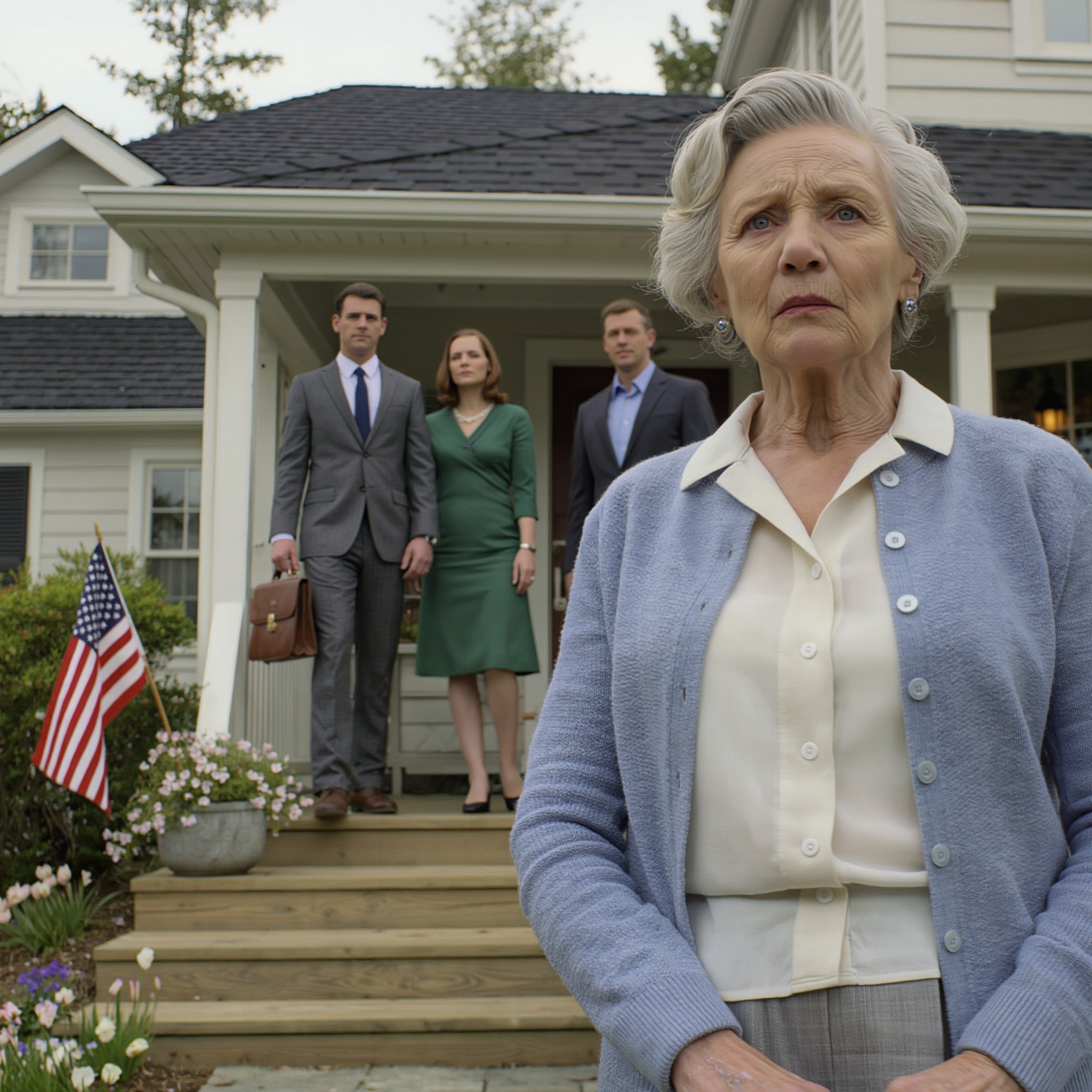

Saturday arrived gray and drizzly—typical Seattle weather. I dressed in a simple blue cardigan and khakis, trying to look like the harmless old woman they expected.

The drive to Bellevue took 30 minutes.

Their condo building looked even more imposing in the rain—all glass and steel and money.

I parked in the visitor spot, pressed the button on the recorder in my purse, and took a deep breath.

Time to see who my son had really become.

Andrew answered the door, and for a moment I saw my little boy—same green eyes, same smile.

But then Diane appeared behind him, and his expression shifted, became guarded.

“Hi, Mom.” He hugged me quickly, barely making contact. “Come in.”

The condo was stunning—floor-to-ceiling windows overlooking Lake Washington, modern furniture in shades of white and gray, abstract art on the walls that probably cost more than my car.

“Your home is beautiful,” I said honestly.

“We worked with an interior designer,” Diane said, not looking up from her phone. “We wanted something sophisticated.”

There was that word again—sophisticated.

The opposite of whatever I was.

A man stood up from the white leather couch. He was mid-40s, wearing an expensive charcoal suit. His hair was slicked back with too much product. His smile was practiced, showing too many teeth.

“Mrs. Morrison, I’m Marcus Webb.” He extended his hand. “I’m a certified financial planner specializing in retirement asset management.”

His handshake was too firm, too long, like he was trying to prove something.

We sat in the living room—me in a stiff modern chair, them on the couch like a united front. Marcus in another chair angled toward me.

“Mom, can I get you some coffee? Tea?” Andrew asked.

“Water would be nice.”

He disappeared into the kitchen while Diane and Marcus exchanged a look—quick, but I caught it.

“Mrs. Morrison,” Marcus began, pulling out an iPad. “Andrew and Diane have asked me to meet with you because they care deeply about your well-being.”

“That’s very thoughtful.” I folded my hands in my lap, channeling every elderly-woman stereotype I could think of—confused, overwhelmed, easy to manipulate.

Andrew returned with water in a glass that probably cost $50. He sat next to Diane, who immediately put her hand on his knee.

Territorial.

“Mom, we’ve been really concerned,” Andrew said. “The house is getting older. You’re there all alone, and we just worry about you.”

“Worry about what, exactly?”

“Your safety,” Diane jumped in. “What if you fell and couldn’t reach the phone? What if someone took advantage of your kindness? There are so many scammers targeting seniors.”

The irony wasn’t lost on me.

They were preparing to scam me, warning me about scammers.

Marcus tapped his iPad.

“I’ve worked with hundreds of seniors in situations exactly like yours. The stress of maintaining a home, managing finances, making complex decisions—it becomes overwhelming.”

“I haven’t felt overwhelmed,” I said softly.

“Not yet,” Marcus agreed, his tone patronizing. “But the statistics are clear. Cognitive decline, difficulty with financial management—these things can sneak up on us as we age.”

Andrew shifted uncomfortably.

Some part of him knew this was wrong, but he wasn’t stopping it.

“We’ve done some research,” Diane said, opening a folder on the coffee table. “There are some wonderful senior living communities in the area—places where you’d have friends, activities, medical care on site.”

She pulled out glossy brochures.

“Evergreen Senior Living in Kirkland is particularly nice. They have a waiting list, but with the right recommendation…”

Senior living.

They meant a nursing home.

I took the brochure with shaking hands—not from fear, but from anger I had to hide. The photos showed smiling elderly people playing bingo, doing chair yoga, sitting in a dining hall that looked like a hospital cafeteria.

“This looks expensive,” I said.

“That’s where smart planning comes in,” Marcus said smoothly. He pulled up a document on his iPad. “I’ve done a preliminary analysis based on public records. Your house in Ballard is currently valued at approximately $650,000.”

My stomach turned.

They’d been researching my assets.

“After selling costs, you’d net around $600,000. Evergreen costs $4,500 per month for a one-bedroom apartment with full services. That’s $54,000 per year.” He showed me a spreadsheet—numbers and projections that made my head spin, deliberately, I suspected.

“With proper investment management—which my firm provides—your funds could last 20 to 25 years, maybe more.”

“What about my Social Security?” I asked. “And James’ life insurance?”

“Those would supplement, of course. But, Mrs. Morrison, the key is professional management. Too many seniors try to handle finances themselves and make costly mistakes.”

Diane leaned forward.

“Mom Ava, we just want you to be safe and comfortable. Imagine not worrying about a broken furnace or a leaky roof. Imagine having people around—activities, care when you need it.”

“Who would manage my money?” I asked, though I already knew.

Marcus smiled.

“That’s the beauty of the plan I’ve designed. Andrew and Diane would be co-trustees of your investment account. They’d work with my firm to ensure everything is managed properly. You’d have complete transparency—monthly statements, quarterly reviews.”

Co-trustees.

Meaning they’d control everything.

“I also prepared some other documents,” Marcus continued, pulling papers from his leather briefcase. “A durable power of attorney, in case you ever become unable to make decisions yourself, and a healthcare directive—all standard elder care planning.”

He spread the papers on the coffee table like a card dealer.

I could see my name already filled in on several lines—blank spaces for my signature.

“This seems like a lot to think about,” I said, my voice intentionally wavering.

“Of course it is,” Diane said with fake sympathy. “That’s why we’re here to help. We’ve already done all the research. All you need to do is sign, and we’ll take care of everything else.”

Andrew spoke up, his voice softer.

“Mom, I know it seems scary. Change is always scary, but Diane and I really think this is best. You’d be so much happier not having to worry about everything.”

I looked at my son—really looked at him.

Was he being manipulated, or was he part of this?

“Can I think about it?” I asked. “This is my home. It’s where your father and I built our life. It’s where I raised you.”

“Of course, you’re emotional,” Marcus said. “But, Mrs. Morrison, emotions often cloud judgment when it comes to financial decisions. The longer you wait, the more you’re at risk. What if something happens? What if you have a medical emergency?”

Creating urgency.

Hayes had warned me about this.

“The spots at Evergreen are very limited,” Diane added. “If we don’t reserve soon, you might miss this opportunity.”

“And there’s one more thing we should discuss,” Marcus said carefully. “I’ve reviewed public records and I noticed your husband worked for a tech company. Sometimes there are benefits—stock options—things that widows don’t even know about.” He studied my face. “Did James ever mention any investments? Property? Anything besides the house and insurance?”

My heart stopped.

Were they fishing for information about the ranch?

This was it—the moment Hayes had prepared me for.

I could feel the recorder in my purse capturing everything.

“No,” I said slowly. “Just the house and his life insurance. That’s all.”

Marcus and Diane exchanged another look—disappointed.

They’d been hoping for more.

“Well, regardless,” Marcus said, recovering smoothly, “the plan I’ve outlined will ensure your security. All we need is your signature on these documents and we can get started immediately.”

He picked up a gold pen—expensive, flashy—and held it out to me.

“I really think I need more time,” I said. “Maybe I should talk to a lawyer first.”

“A lawyer?” Diane’s voice sharpened, then caught herself. “Mom, lawyers just complicate things, and they’re expensive. This is family. You can trust us.”

Andrew nodded.

“We just want to help, Mom.”

The room felt smaller suddenly.

Three of them—all watching me, all waiting for me to sign away my independence.

“Let me take the papers home,” I said, reaching for them. “I’ll look them over—”

“Actually,” Marcus interrupted, pulling the papers back, “these documents need to be notarized when signed. I have a notary on call who can come here. It’s better to do everything at once—properly.”

“I’m feeling a bit overwhelmed,” I said truthfully. “Can we schedule another time? Maybe next week.”

Diane’s smile was brittle.

“Mom Ava, you’re not getting any younger. Every day you delay is another day of risk. What if something happened to you this week? What if you had a stroke? Who would handle everything?”

Diane’s right,” Andrew said. “It’s better to get this done now—while you’re healthy and can make clear decisions.”

While I can make clear decisions—the implication being that soon I wouldn’t be able to.

I stood up, clutching my purse.

“I need to use the restroom.”

“Down the hall, first door on the right,” Andrew said.

I walked down the hallway on shaking legs.

In the bathroom—all white marble and chrome—I ran cold water over my wrists, trying to calm down.

I could hear their voices, muffled from the living room.

I cracked the door open slightly.

“She’s resisting more than expected,” Marcus was saying.

“She’s stubborn,” Diane replied. “Always has been.”

“Maybe we need to take a different approach,” Andrew said. “This feels too aggressive.”

“Your mother needs protection, Andrew. Whether she realizes it or not.” Diane’s voice was cold. “If we have to push harder, we push harder.”

“What if we can’t get her to sign?” Andrew’s doubt crept into his voice.

“Then we go to plan B,” Diane said.

“We petition for conservatorship. We show the court she can’t manage her own affairs—with Marcus’ testimony as a financial expert and documentation of her declining state.”

“She’s not declining,” Andrew protested weakly.

“She will be once we document it properly. Missed appointments, confusion about finances, erratic behavior. It’s not that hard to build a case.”

My hands gripped the marble counter.

They were planning to have me declared incompetent.

I flushed the toilet, ran the water loud enough to cover my movements, and returned to the living room.

“I’m sorry,” I said, gathering my coat. “I’m not feeling well. I think I need to go home.”

“Mom, wait,” Andrew started.

“Please, just let me think about all this. I’ll call you in a few days.”

Marcus stood, blocking my path to the door.

“Mrs. Morrison, I strongly advise you to consider the risks of delay. As your son said, you’re not getting any younger.”

“I understand.” I moved around him. “Thank you for your time.”

Andrew walked me to the door.

For just a moment, when Diane couldn’t see his face, he looked guilty.

“Mom, I really do think this is best for you.”

I touched his cheek the way I used to when he was little.

“Do you, Andrew? Do you really?”

He couldn’t meet my eyes.

I drove home in the rain, my hands tight on the steering wheel.

The recorder in my purse had captured everything.

When I got home, Rachel was waiting on my porch—umbrella in hand.

“How bad?” she asked.

“Worse than we thought.”

We sat at my kitchen table and listened to the recording—every manipulative word, every veiled threat.

Diane’s cold voice discussing conservatorship like it was a business strategy.

Rachel’s face got redder and redder.

“That absolute—call Hayes,” I interrupted. “Tell him we need to meet tomorrow.”

“What are you going to do?”

I thought about James’ letter, about protecting myself, about the ranch they didn’t know existed.

“I’m going to let them keep digging their hole, and when they’re deep enough, I’m going to bury them in it.”

Sunday morning, Robert Hayes met us at his office.

“Emergency meeting,” he’d called it.

He listened to the recording twice, taking notes.

When Diane’s voice said the word conservatorship, his jaw tightened.

“This is actionable,” he said finally. “This is conspiracy to commit elder abuse. If they follow through, we can file criminal charges.”

“I don’t want to send my son to jail,” I said.

“Your son is complicit in a plan to steal your independence and your assets. You need to accept that.”

The words hurt, but he was right.

“What do we do now?”

Hayes pulled out a thick folder.

“I’ve been busy this week. First, the irrevocable trust for the ranch is complete. It’s untouchable. Even if they somehow got power of attorney—even if they got conservatorship, which they won’t—they can’t access it.”

“Second, I’ve prepared a cognitive evaluation report from Dr. Sarah Martinez, a geriatric psychiatrist. She reviewed your medical records and agrees to testify that you show zero signs of cognitive decline or incompetence.”

“Third, I filed a preemptive legal document with the court. It’s essentially a declaration of competence supported by medical evidence. If they try to petition for conservatorship, the judge will already have our evidence on file.”

Rachel squeezed my hand.

“You’re building a fortress.”

“Exactly,” Hayes agreed. “But there’s one more thing we need to discuss. The endgame.”

“What do you mean?”

“They’re going to escalate. They’ll call more often. Pressure harder. Maybe even show up at your house. We need to document every interaction, but we also need to plan for the confrontation.”

“What kind of confrontation?”

“The moment when they realize you’re not going to cooperate. That’s when people like Diane show their true colors. And that’s when we want witnesses.” He leaned forward. “I want you to invite them to your house. Tell them you’re ready to discuss their plan. Let them come with their notary, their documents, their schemes—but when they arrive, I’ll be there too.”

“With an investigator from the King County Prosecutor’s Elder Abuse Unit,” he added.

My heart raced.

“You want to catch them in the act?”

“I want to protect you legally, yes. But more than that, I want your son to see what he’s involved in. Sometimes people don’t realize they’re on the wrong path until someone shines a light on it.”

Over the next 2 weeks, the pressure increased exactly as Hayes predicted.

Diane called every other day.

“Have you thought more about Evergreen, Mom? The waiting list is getting longer.”

Andrew texted:

“Mom, we really need to talk. Can I come over?”

Marcus sent emails with subject lines like urgent estate planning deadline and time-sensitive your financial security.

I responded to each with variations of I’m thinking about it and soon, I promise.

Meanwhile, Hayes prepared.

He brought in Daniel Brooks, an investigator from the elder abuse unit—a serious man in his 50s with kind eyes and a no-nonsense demeanor.

“Mrs. Morrison,” Brooks said when we met, “I want you to know we take these cases very seriously. Elder financial abuse is one of the fastest growing crimes in Washington state. Most of it happens within families.”

See more on the next page

Advertisement